Best Virtual Credit/Debit Cards In The USA – Top 10

People are more likely than they were a few years ago to give up their love of cash, receipts, and coins in favor of the ease of their digital alternatives.

Virtual credit and debit cards and other forms of digital currency are gaining widespread acceptance. The extent to which digitalization has spread is demonstrated here. The habit of bartering and trading without the use of currency has become commonplace. They also appear prepared to enter the brave new world of cashless transactions.

Simply put, a virtual debit or credit card is an illegitimate card that exists solely in cyberspace. Their natural counterparts’ randomness is preserved in their 16-digit card numbers, CVV numbers, and expiration dates. These cards can be used for purchases wherever standard credit cards are accepted.

Debit and Credit Cards In the USA That Can Be Used Online

There are several reasons why these cards are becoming increasingly popular. Online and one-time purchases benefit significantly from them, first and foremost.

The procedure of applying for a virtual card is both quick and easy. Plus! If you want to make purchases online but don’t have a credit card, you can utilize a virtual equivalent.

To get right to the point, there are many reasons virtual payment cards are gaining popularity.Well-known companies compile the list with a good reputation for being secure and trustworthy in their respective fields.

Following Is The List Of Best Virtual Credit Cards

#1) Payhawk

Best for both physical and virtual visa credit cards.

Payhawk gives businesses physical and digital Visa credit cards backed up by a full suite of financial tools. This gives companies more control over how their business cards are used. With this software, managers can keep track of payments, set spending limits, and see what costs are still being charged to the card.

You can also change how much your employees spend using policies, rules, and limits with the app. These rules are easy to use for both individual cards and team cards. You can freeze the card immediately or change how it can be used in real time.

Features:

- Automatic sync with financial tools in real-time

- Limit how much you spend

- Real-time control over regular expenses and ATM withdrawals

- Streamlined handling of a lot of cards

Verdict: Payhawk gives companies some of the best physical and digital credit cards. This card works well with Payhawk’s software, and managers can use it to keep track of expenses and limit spending in real-time.

Price: Each month, a Premium Card costs $199. The cost of the All-in-One Spend Plan is $299 per month.

Website: Payhawk

#2) Privacy.com

Best for US Citizens who want safe virtual cards.

After strict internal and third-party checks, Privacy.com gives you a virtual credit card. This makes using the virtual cards you get from Privacy.com very safe and secure. If you want to pay for the cards with money from a bank account, you don’t have to pay anything. We suggest using virtual cards from Privacy.com on websites that need regular payments.

Features:

- Up to 60 cards can be made per month.

- Personalized customer service

- Cards that can only be used at one store

- Limit your spending

Verdict: Privacy.com’s virtual debit and credit cards are safe and secure and come with many useful features. But you can only use Privacy.com to apply for a virtual card if you are a US resident. The time it takes to apply is minimal, and the delivery of your digital card will take place within 24-7 days.

Price: There is a free plan for life, a $10 per month Pro plan, and a $2 monthly Teams plan.

Website: Privacy.com

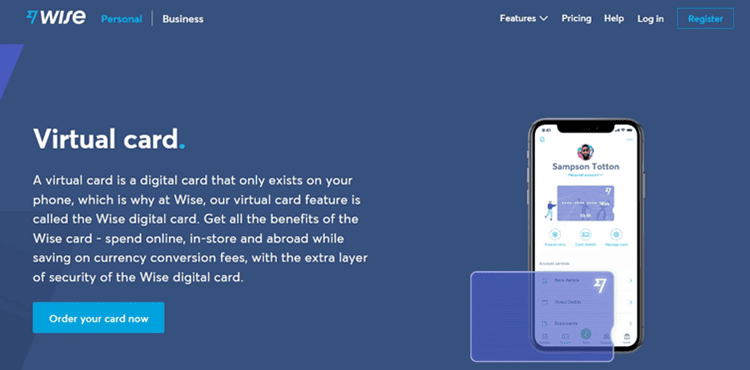

#3) Wise Virtual Credit Cards

Accurate exchange rates are the most useful tool for monitoring financial outlays.

Wise provides its users with a virtual credit card that can be used for all of their purchases while they are away from home. You can count on precise exchange rates when making an online purchase with your new false card.

After each use, the card can be frozen, which makes it great for stopping scams. You can be sure that the UK Financial Conduct Authority has permitted Wise to give you a virtual card.

The card can hold more than 50 different coins at once. With the Wise app, you can change these currencies in real-time. Also, these changed currencies can be used later without any trouble buying things online, in stores, or abroad. You must order an actual card first to get a virtual card from Wise.

Features:

- After each use, freeze the card.

- Get as many as three fake cards at once.

- Use live exchange rates to shop all over the world.

- Customers with personal and business accounts can use it for free.

Verdict: The virtual card from Wise is for people who travel a lot and want an extra layer of protection when they shop abroad. In three easy steps, you can get your virtual card. It will then stay in your Wise account, where you can access it whenever necessary.

Price: Once you sign up with Wise, the card is free. If you want to accept USD wire payments through them, it will cost you $4.14 more.

Website: Wise Virtual Credit Cards

#4) Emburse Spend

Best for Giving workers virtual cards for expenses that can be used once or repeatedly.

With Emburse Spend, you can give your team both one-time-use and regular virtual cards. With these cards, you can see everything your employees do with their money in real time. You can set a maximum budget and pre-set approval processes on the card to track how much your business spends.

Each purchase made with these cards can be checked at the point of sale. These cards make automatic reconciliation possible because they record information about receipts and expenses right at the point of sale.

Features:

- Automatic matching of expenses

- Spending data in real-time

- Full protection against fraud

- Add both digital and real cards to mobile wallets.

- Set up rules to keep spending in check.

Verdict: With Emburse Spend, you can give your team both real and digital cards that let you see and control everything they spend. You can take charge of your company’s costs by setting rules and spending limits that are automatically enforced.

Price: Contact for pricing, free demo available

Website: Emburse Spend

#5) DivvyPay

Best for seeing all activities in real-time.

When you use Divvy, setting up a fake card is easy. The platform lets you make a different subscription card for each seller your business works with. Then, you get to decide how much money is on the card. The card’s cap on how much money it can hold is reset monthly. This ensures that all your bills are paid on time and you aren’t charged extra.

You can also see all transactions with the fake card in real time. The best thing about these cards is that they keep people from being victims of scams. The card saves you from being overcharged by a vendor or having your account stolen. If you see suspicious behavior on a card, you can immediately freeze it.

Features:

- Each seller has their card number.

- Handle payments that keep coming.

- Instant alerts when money is spent

- Keep track of spending in real-time

- Set a spending cap

- The card can be frozen when needed.

Verdict: Divvy’s virtual cards are handy whether you want to avoid fraud or keep track of costs for a project. We suggest using Divvy to make virtual cards so you can pay vendors or make one-time online purchases.

Price: Get in touch to get a price

Website: Divvy

#6) US Unlocked

The best way to reach US stores for easy online shopping.

This virtual prepaid card may be best known for letting people shop at several US stores worldwide. Signing up for their service, putting $50 on the card, and paying a small fee was all you had to do to use the card to make one-time purchases from a variety of US retailers.

The virtual card comes with a payment and shipping address in the US, which makes it easy to shop at US stores. You can get quick access to services like Netflix US, Hulu, and HBO Max that are only available in the US.

US Unlocked gives you two kinds of cards. The first card can only be used once and can only be used once. The other is a card that only works at a particular store and can only be used there after a transaction.

Features:

- US billing and mailing address was given

- Limit your spending

- Visit US-only websites

- Links to partners in goods shipping

Verdict: US Unlocked gives you a sound virtual card that lets you easily visit any US-only website you want. All you have to do to use it is sign up and pay a small fee based on how much money you put on your card. With the cards you get from US Unlocked, it’s easy to shop online.

Price: It varies on how much you load, and there is a $15 membership fee for life.

Website: US Unlocked

#7) Payoneer

This is the best way to pay online.

With Payoneer’s virtual card, you can buy things from eCommerce shops that take MasterCard. Payoneer’s virtual payment card is the same as an actual card. You have to put your card information on a payment page.

If you already have an account with this service, getting a Payoneer virtual card is easy. You have to fill out the information online at Payoneer’s site. The business looks at the information you gave them later before giving you a virtual credit or debit card.

Features:

- For fast online shopping

- Simple to use.

- Shops that accept MasterCard can accept it.

- With a Payoneer account, it is free.

Verdict: If you have a Payoneer account, its virtual card service will significantly help you. It is easy to get and lets you buy things online quickly. These cards are great for buying one-time entry to an online service.

Price: Free

Website: Payoneer

#8) Netspend

Best for making prepaid cards that fit your needs.

Netspend is a great way to manage your money online. It gives users a virtual prepaid card they can personalize with any picture or sign they want. The service is beneficial for making a fake card number that you can use to get into sites that don’t accept debit cards.

The card is easy to use all over the country, and both your bank card and credit card information are well protected. You can also check your balance quickly at any time and from anywhere. With Netspend’s virtual credit cards, you can also get transaction reports as text messages, which is very helpful.

Features:

- Deal across the country

- Check your balance while moving.

- Short-term use

- Fully able to be changed.

Verdict: Netspend’s fake card should come in handy when using a debit card on a site that doesn’t accept them. Users can check their activities and account balances in real time from anywhere worldwide.

Price: Contact for pricing

Website: Netspend

#9) American Express

Best for people who work on their own or contracts.

You already know how hard it is for a self-employed person to get a credit card. That’s why American Express provides its clients with a convenient and secure online credit card service.

Freelancers, digital marketers, and writers who work for themselves can use this virtual card to buy things online. With this VCC, keeping track of everything you buy and sell is easy. You can also set limits on how much you can spend, which lets you know how much you will be charged.

Features:

- Simple to use

- Follow what’s going on

- Manage your money

- Pay with your cell phone

Verdict: American Express gives users access to a virtual credit card service that is made for people who work on their own. It is easy to use, beneficial for keeping track of transactions, and lets you make smooth payments with limits on how much you can spend.

Price: Free to use

Website: American Express

#10) Walmart MoneyCard

Best for managing money on a computer.

With the Walmart MoneyCard, you can access a complete digital financial system that meets all your banking needs. Walmart MoneyCard funds can be added instantly at any U.S. bank. Using this cash will make internet shopping a snap.

The MoneyCard app also allows for free withdrawals at any Walmart location in the United States. For those over the age of 13, the MoneyCard app allows for adding four more virtual debit card accounts.

Features:

- Free money refills

- Money from any bank account can be added.

- Get a 2% return on the money you save.

- Set up a fake debit card account for the family for four more people.

Verdict: The Walmart MoneyCard is an advanced digital payment system/app that facilitates better financial management. The app on your phone allows you to deposit funds, save additional funds, earn interest, shop, and do much more.

Price: Free to download and use

Website: Walmart MoneyCard

Conclusion

There are just too many good reasons to use a virtual credit or debit card instead of a physical one. It is beneficial, easy to use, and very safe and effective. It is also a must-have for freelancers and independent workers, who often need help getting an actual credit card from a bank.

As for what we suggest, go with the US Unlocked if you want a virtual card that lets you shop online at several US merchants, eCommerce stores, and retailers. We highly suggest you try Walmart MoneyCard if you want a powerful app that works great as a one-stop shop for managing your money and gives you a virtual card.