Copy Trading Platforms In 2024 – Top 10

Social trading takes the form of “copy trading,” in which participants view the profiles of other traders and, if they like what they see, “copy” their trading tactics in the hopes of higher profits or even free foreign exchange.

These days, copy trading platforms let users follow other traders, buy and sell trading alerts, and connect to broker platforms where copy trading can be done automatically.

This guide shows you how to do copy trading and lists the best sites for it.

What Is Social And Copy Trading

Social trading is a way to trade on the financial markets where people can watch how other users do. It is best known as a strategy for people just starting to trade, but not all broker trading platforms allow it.

Those that support it may allow users to:

- On the copy trading site, you can look at the profiles of other traders.

- Check out other traders’ profiles to see how many fans or copy traders they have, the total amount of money they’ve invested and how much each copying trader has invested.

- Check out the details of other traders to see how many trades they’ve won and how much money they’ve made.

- Check how long other traders have been dealing with a particular commodity.

- Look at how much money traders who follow a specific seller make on their investments.

- Talk to other buyers. On top of that, they can post on social media sites, reply to posts, and so on.

- Get skilled market and financial analyses of a particular asset.

- You can buy and sell trading signals for a particular asset on the copy trade program.

Following Is The List of Top Copy Trading Platforms

#1) 3Commas

Best for traders who want professional tools that are very powerful and easy for newbies to use.

3Commas is a platform that lets people trade with bots in simple to complex ways. Users can pick one of 21 bots that can be changed in many ways and use it on 16 cryptocurrency markets. It lets people run multiple trading bots at the same time. They can also copy the trades of skilled traders and use their strategies in their bots.

Users can keep an eye on their crypto portfolios with 3Commas, set them to rebalance themselves or through a bot, adjust them by hand, and make money from them in any way they choose. For example, they can link all of their wallets on different exchanges and keep an eye on how their portfolios are doing while choosing how to invest in each coin.

You can also make a portfolio of your favourite coins from the homepage. You can give the portfolio any name, link it to the market you want to use, add or remove tokens, and set the rate at which each coin is used.

Features:

- More than 330,000 DCA bots run every month.

- In the past year, 10,583 new people made money in their first month.

- DCA bots already have tactics set up, so you don’t have to wait long to start.

- You can check in on your portfolio at any time and place with our iOS and Android app.

Minimum Investment: $1

Fees/Charges: There are zero transaction fees. The cost of the subscriptions ranges from $22 to $74 each month.

Website: 3Commans

#2) NAGA

Best for dealing with other people on public social networks.

New users, in particular, can benefit from the platform’s ability to replicate the investments of over 9,000 experienced traders or strategy providers who have passed the platform’s stringent selection criteria. The most-traded financial instruments on the site can be seen on the “Most Traded” tab. Users can add these instruments to their “favourite” list by clicking the star next to them.

If you want to copy someone, the platform lets you look at trade and trader data to help you choose who to copy.

Profitability, trading direction, number of pips, take profit and stop loss orders, and other factors all play a role. Their win rate, the people they follow, their profile and loss profile, those who visit their profile, and the people they copy are all shown.

Features:

- Tools for learning and study. Watch some videos first before you start copying moves.

- You can withdraw money from bank payments, bank cards, Sofort, Neteller, Skrill, and cryptocurrencies.

- Users can sell more than 1,000 different types of financial instruments.

- Plan suppliers can make money.

- You can change the amount you invest and other details as you copy the deal.

- In a lot of ways, it’s like a social network. You can read news about the market, find information posted on brokers’ public channels, and write or chat with other traders.

- The least you can spend is $250.

Fees/charges: Pay no service fee. Share CFD copy trading costs 0.2% per lot, while ETFs cost only 0.1%.

Spreads: Spreads begin at 1.0 pips and average 2.5 pips.

Website: Naga

#3) eToro

Best for social and copy trading.

In addition to sending and managing crypto, eToro lets you trade and buy in it. It lets you exchange over 20 cryptocurrencies for cash and buy, sell, or withdraw using several payment methods. These include bank accounts, debit and credit cards, Sofort, Skrill, Wire Transfer, Neteller, WebMoney, PayPal, Rapid Transfer, and more.

Largest and most well-known copy trading site in the world.

Features:

- iOS and Android phones, as well as PCs and the web.

- Use other users’ investment and trade plans as a guide.

- 100k in a virtual account when you join.

There are terms. You should only spend money if you’re ready to lose it all. Putting money into this is risky, and you shouldn’t think you will be safe if something goes wrong. Spend two minutes finding out more.

Website: eToro

#4) FX2

Best for actual money trading.

For traders, FX2 is a website that gives them the tools and information they need to trade in any way they choose. What traders like about FX2 is that it lets dealers start with real money. Most firms that deal in props give their buyers demo accounts, but FX2 does not.

After you pass a short test, you can trade on a real account with a natural history. You will also be able to look for more money. Another thing we like about FX2 is how easy it is to trade. There are limits on how long you can stay. The platform lets you hold trades over the weekend and trade news, making it easier to pass and get funds.

Features:

- 85% of the profit

- No need to stop losses

- Evaluation in one step

- Up to $200,000 in funded accounts

- Easy Money Outs

Fees/Charges: To open an account with at least $10,000, you must pay a one-time fee of $125. For the intermediate account, there is a single payment of $315, and you need to deposit $25,000. The business account entails a one-time fee of $500 with $5,000 in funds.

As for the professional and master accounts, both require a single payment of $900, and the professional account necessitates a $100,000 deposit, while the master account requires $200,000. There is a one-time fee of $1800 for a master-paid account.

Website: FX2

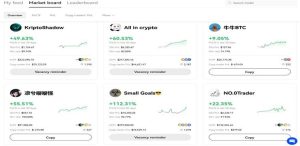

#5) OKX

It is best for spot and futures crypto buyers who trade a lot.

OKX has a social trading site called copy trading, where some excellent traders teach other people how to trade so they can make money. Beginner traders use the function to make money, trading quickly, easily, and without knowing much about trading.

This is more complex than it sounds because a new trader must take time to learn the right skills and strategies to deal with the market. Also, crypto trading strategies sometimes pay off. Some days, you’ll make money; some days, you’ll lose money because you copied trades. The book is still an excellent place to start if you need to learn how to make your trading methods.

Anyway, people who want (or plan for) their trades to be copied do their best because it increases their profits if many profit from the copied trades.

Traders can see each other’s trade records, risk levels, profits, losses, and the breakdown of their portfolios. They can copy each other’s strategies with this information and data. Pro traders can become “lead traders” and get a 12% cut of the profits from anyone who copies their deals.

Features:

- Traders’ top lists.

- Keep an eye on, control, and get rid of copied trades.

- Trader statistics and trade activities in real-time. This has charts for the trader’s profit, loss, and win rate.

- Discover what you need to know about copy selling and how to do it.

- There are no extra fees on top of the fees that come with your trade level (up to 0.1% taker and 0.08% maker).

- You can copy trade BTCUSDT, ETHUSDT, ETCUSDT, XRPUSDT, SOLUSDT, ADAUSDT, DOGEUSDT, LTCUSDT, DOTUSDT, and EOSUSDT contracts.

- A lead seller can only be copied by several other traders. Every day, a star trader can show you 50 trades to copy. After this, you can no longer copy the trader’s trades.

- You can lose your standing as a lead trader.

- Use up to 100 times your BTC balance and 50 times your other coins (ETH, XRP, SOL, ADA, DOGE, LTC, DOT, EOS, etc.). Traders do the same thing here.

- Spread safety of 0.5 per cent when a position is opened. The trade is not copied if the copy trader’s opening price is more than 0.5% of the lead trader’s starting price.

- As a copy trader, you can limit how much the trader can copy per order and allow them to copy up to a certain amount.

Minimum Investment: There are no minimums.

Fees/charges: The active trading fee starts at 0.10% for the taker and 0.080% for the maker. It goes down to 0.080% for the taker and 0.060% for the maker based on how much OKB is held and how much trading is done. VIP users get a taker fee of 0.080% to 0.02% and a maker fee of 0.06% to 0.005%.

You might have to pay an extra 4% per transaction when you use fast payment methods like Visa and Mastercard.

Website: OKX

#6) TradingFunds

A one-step test should become a funded dealer.

TradingFunds is a brand-new company that traders on props. It gives users the money, technology, and set-ups they need to trade on financial markets. The company has only been around for a short time. Still, it is already getting much attention for its professional growth programmes, competitive payout structures, and helpful community of traders.

TradingFunds doesn’t put too much time pressure on its clients. You are not bound by strict rules regarding the duration of your trading days, allowing you to begin trading more as soon as you achieve your earning target. Furthermore, you can conveniently withdraw your earnings every two weeks. There are also no limits on how much you can withdraw each day.

Features:

- Control panel for monitoring trading stats and quickly withdrawing money

- Up to 90% profit split

- Live chat with experienced trader agents

- Withdraw profits on a bi-weekly basis and become a funded trader with a single evaluation

Minimum Investment: $25000 provided by TradingFunds

Fees: Minimum capital required of $25,000 with a $199 refundable registration charge.

Website: TradingFunds

#7) Ultimate Traders

Best for evaluations with two stages.

Ultimate Traders is a tool for prop trading that aims to help you reach your full trading potential. You’ll have to pass a test before you can join this site. First, you pick the size of your account. Once you’ve picked an account size, you can choose between a single-phase or double-phase evaluation.

If you pass the test, the company will give you the money you need to start dealing. You can make up to 90% of your income through the programme. There is a signup fee, but it is returned to you once your account has enough money.

You have the option to choose from various account sizes, with the ability to start an account with as little as $10,000. Your potential earnings can reach up to $400,000, contingent on your performance.

Features:

- Share of the profits of up to 90%

- You can use EA, hedge, and scalp.

- One hundred to one leverage is available for trading.

- No limits on trade days

- You can choose from several account sizes.

Fee: There is a small fee to sign up, which changes based on the size of your account and the type of review you choose.

Website: Ultimate Traders

#8) AvaTrade

It is best for experienced buyers and new traders.

AvaTrade has been around since 2006 and does more than copy trading. It also teaches investors how to study and invest. Due to strict rules in tier 1 and 2 jurisdictions, it is one of the safest sites. The business has five platforms: AvaTrade, WebTrader, AvaOptions, ZuluTrade, and DupliTrade, which are social trading systems.

It lets people trade cryptocurrencies and other assets using CFDs, contracts for differences that let users guess how prices will move in the future. Users don’t have to buy, hold, and handle their crypto or portfolios. Instead, they can guess how prices will move and make money from the difference.

Features:

- Desktop, web, and the AvaTradeGo app for phones.

- Traders new to the site can follow, copy, and trade after the moves of more experienced traders. This shortens the time it takes to learn and get to market. Let’s trade on new assets and assets you need to learn more about.

- Ask experts questions, get help from mentors and trading groups, learn trading techniques, and find expert traders.

- Make social trade automatic.

- You can use Litecoin, Bitcoin, Bitcoin Cash, Ethereum, Gold, EOS, Ripple, and Bitcoin.

- AvaSocial and Pelican Trading work together to make social trading tools possible.

Minimum Deposit: $100.

Fees/charges: $100 for account opening, $50 fee for three months of inactivity, and $100 administration fee after one year of inactivity.

Spreads: We offer a spread of 0.9 pips on the EUR/USD for micro accounts and 0.6 pips for institutional investors.

Website: AvaTrade

#9) B2Broker

Best for copy trade by big businesses.

Copy trading is possible on this site. Users can trade forex, CFDs, and cryptocurrency. Since it’s called “B2B,” it mainly works for selling and investing between institutions.

But it also makes training and spending on an individual level easier. The business began in 2014 and is based in Russia. It has dealers for cryptocurrencies, forex, crypto exchanges, social trading, wealth management, bonds, futures, and stocks, among other types of trading.

There is a wide variety of B2B broker trading kinds, including liquidity providers, trading tool providers, white label solutions, CRMs, regulators, affiliate programmes, and websites.

Regarding social trading, exchanges and brokerages allow three types: trading pools, multi-account managers, and copy trading. Anyone can join a trading pool and earn a share of the profits.

Click here to read about the year’s most popular forex trading platforms.

Features:

- X-Station, MT4, and cTrader for PC, mobile, and web trading.

- Test accounts.

- Help for customers.

Minimum Deposit: $20,000

Fees/charges: $2,000 monthly.

Spreads: From 0.00000 pips

Website: B2Broker

#10) ZuluTrade

Best for all-around automatic copy trading.

ZuluTrade has more than a million users worldwide and more than $800 billion worth of trades every day. It began in 2014, so it has a lot of users with good track records, making it very competitive with eToro when it comes to copy trading. ZuluTrade lets traders with a lot of experience make money by sharing their trades with others.

People who want to copy trade on the site can look at the profiles of other users to see how much money they have available for copy trading by users following them, how much money those users hold, and the annual return on Investment (ROI).

Features:

- $1 to $300. It is possible to trade crypto automatically with AutoTrade.

- You can buy and sell stocks, commodities, CFDs, crypto, and more than 40 financial products.

- Regular people in the UK can’t trade crypto. Some people can sell Litecoin, XRP, Bitcoin Cash, Ripple, and Bitcoin.

- The least you can trade is $1.

- Check how much money each follower trader made on any given followed dealer.

- It works with MetaTrader 4 and 5.

- No dealing with leverage.

- There are also iOS and Android apps, as well as a website.

- Social trade of crypto that is automated with ZuluTrade and scripts APIs.

Minimum Deposit: Between $1 and $300, depending on the broker.

Fees/charges: Each contributor pays $21 monthly.

Spreads: From 0.6 pips.

Website: ZuluTrade

Conclusion

This lesson was mainly about copy-sharing apps. The best apps have the smallest spreads and charge the most minor fees. They also let you trade risk-free and with leverage.

AvaTrade is much better than B2Broker because it has low fees and deposits. EToro and ZuluTrade have been around for a while, have low minimum deposits, and let users trade in many different financial assets.