Best PayPal Alternatives For Online Payments In 2023 – Top 10

PayPal, a popular online payment method, can replace cash and cheques. Elon Musk, Peter Theil, and Max Levchin started the company in 2002. It helps people send money to each other online.

But you can’t use PayPal everywhere. As of 2021, 20 countries cannot use the online payment method. Some companies also don’t like PayPal because it has high chargeback fees and can freeze accounts for what it considers to be suspicious activity, which can take months to clear up.

List Of Best PayPal Alternatives

#1) Merchant One

It is best for both small and large merchants, as well as online business owners.

Merchant One has an excellent payment gateway service because of how many shopping card connections it supports and how secure it is. More than 175 shopping carts can be linked to the gateway by businesses. It also has data protection and fraud detection features built right in.

Merchant One also has a virtual terminal that can process deals manually. You can choose between an in-house and a white-label gateway from a third party.

Features:

- Allows for recurring payments

- Advanced Payment Authentication

- Create an invoice

- Plug in for QuickBooks

- Better ways to find fraud

- Checkout with a host

- Detailed reporting

Verdict: Merchant One is a payment service that gives sellers all the tools they need to run a successful business. The method is just as good as PayPal regarding how easy it is to use and how well it protects your information.

Price: Contact for a quote

Website: Merchant One

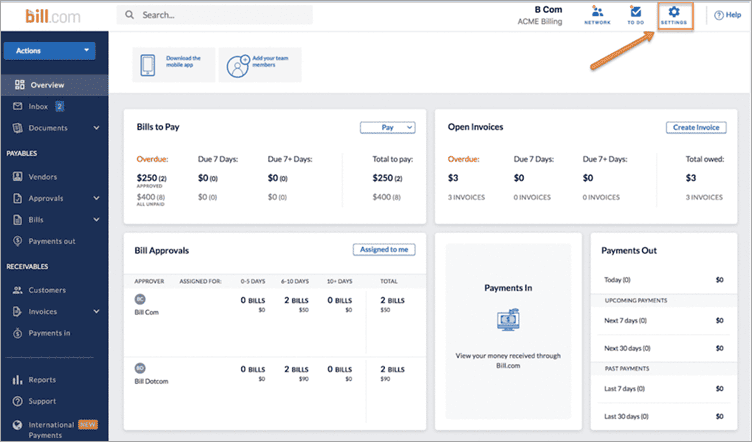

#2) Bill.com

Best for small and medium-sized businesses, accountants, banks, etc.

Bill.com is a powerful tool for automating AP and AR processes, offering innovative ways to handle bill payments. It seamlessly integrates with financial software like Oracle NetSuite, Sage Intacct, Xero, and Intuit QuickBooks, ensuring effortless synchronization. Furthermore, Bill.com simplifies data integration by allowing the loading and exporting of CSV templates from programs such as Microsoft Dynamics, Sage, SAP, and FreshBooks, making it easy to consolidate data from these platforms.

Features:

- Bill.com has tools like data entry that is done automatically.

- It can find bills that are the same.

- It gives new ways to pay, like virtual cards, ACH, and foreign wire transfers, more freedom.

- It is shared in the cloud, so your Team can work in real-time from anywhere and at any time.

Verdict: Bil.com has a single platform that lets you connect all your payment accounts and accounting tools in one place and make purchases automatically. It has intelligent functions that use machine learning to work. This will save time and cut down on mistakes.

Price: Bill.com has four plans for the solution: Essentials, which costs $39 per user per month; Team, which costs $49 per user per month; Corporate, which costs $69 per user per month; and Enterprise, for which you can get a price.

Website: Bill.com

#3) Helcim

The best for mid-sized to big businesses.

Helcim is a tool that stands out from similar ones because it lets you make hosted payment pages. You can easily connect your current billing system, shopping cart, website, and other third-party apps to the payment gateway API you get.

Once you’ve set up the hosted payment page, you can use it to add QR codes, make shopping carts, save credit cards, set up regular payments, and get payments for invoices.

Features:

- Payment by QR Code

- Make a shopping cart with a ‘Buy Now’ button.

- Signing up a customer

- Payments for bills

Verdict: Helcim lets you add seamless payment features to your websites, which can be used for more than just collecting payments online. It is highly customizable and easy to set up.

Price: Helcim uses a price method called “interchange plus.” This means that you will have to pay more than the exchange rate.

Website: Helcim

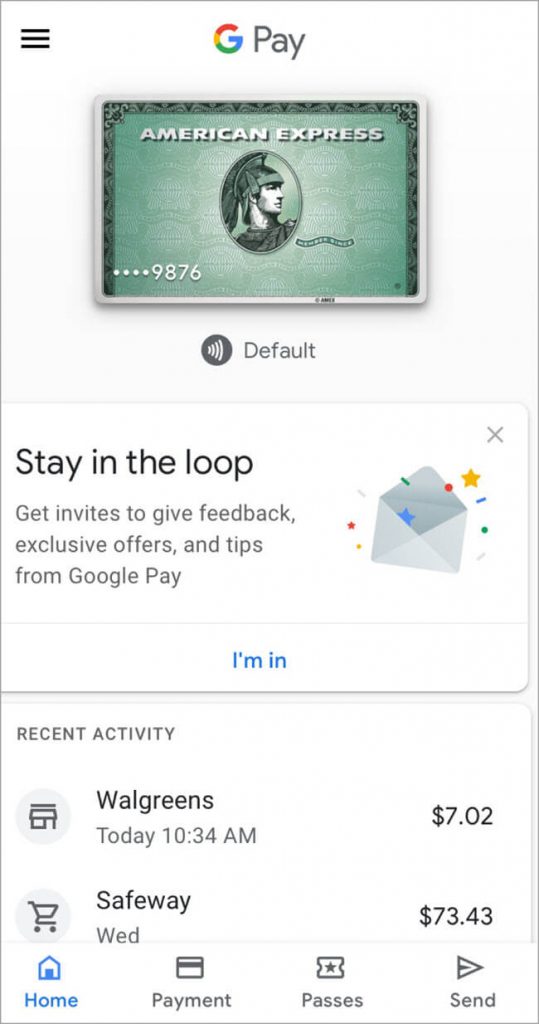

#4) Google Pay

This is the best way for people and businesses to make online payments and get records for free.

Google Pay is an option to PayPal that lets you pay for things online for free. When the app came out in 2015, it was called Android Pay. In 2018, the name was changed to Google Pay. Users can use their debit, credit, or gift cards to pay for things on supported systems with the mobile payment app, even if they don’t have the cards.

Merchants can sign up for Google Pay to accept payments from customers shopping online without paying fees.

Features:

- You can pay in person or online.

- Purchases made within the app

- Switch money

- Twenty-eight countries can get it.

- You can send the most $9,999 per transaction and $50,000 in 5 days.

Verdict: Google Pay is a free app that lets you pay with your phone. It is used by big banks all over the world. People can add cards that work with the account. Residents of specific places, like the EU, UK, US, Australia, Russia, North America, and Brazil, can use the services.

Price: Free

Website: Google Pay

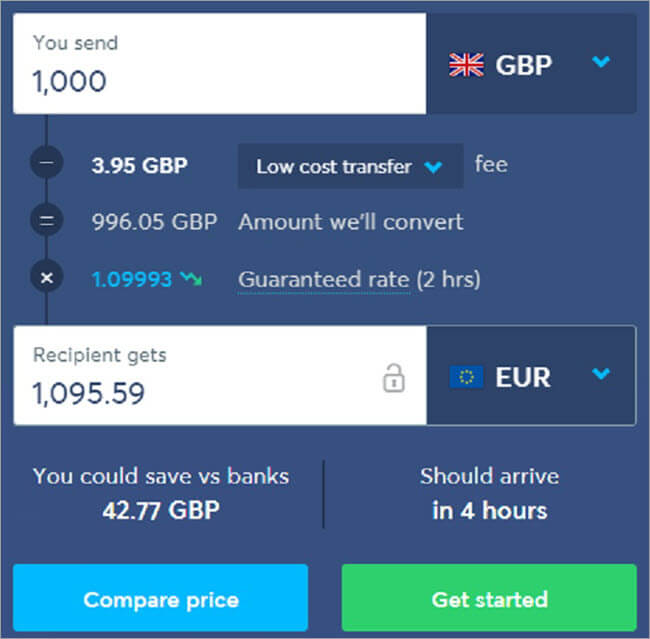

#5) TransferWise

This is the best way for people and businesses to move money from one country to another.

TransferWise is an online payment service based in the UK that opened in 2011. People can send money to banks in more than 30 different countries. The fee is based on how much and what kind of money is being sent. Most of the time, the fee for a bank-to-bank transfer is much lower than what regular banks and money transfer companies charge.

Residents of the EU, UK, Singapore, Australia, New Zealand, and the US can use the services, but residents of Hawaii and Nevada can’t.

Features:

- Transferring money across borders

- Low fees to send money

- Transferring more than 57 different funds

- No fees to sign up

- The most you can send is $1 million, which varies for other currencies.

Verdict: TransferWise is a safe and inexpensive way to send money online. The company is licensed to send and receive money electronically in the UK, the US, and Australia.

Price: It depends on the amount and the type of money. For transfers in US dollars and some other currencies, like the Philippine Peso, you will be charged 1 percent. The fee for most currencies, though, is 0.5%.

Website: TransferWise

#6) Venmo

Best for people making online payments and moving money from one bank account to another.

Venmo is a peer-to-peer payment app for mobile phones that lets people send money to each other. You can also pay some internet merchants with the online app. The PayPal app can only be used by people in the US right now.

Features:

- Payments between individuals

- Online shopping

- The most you can pay per buy is $2,000, and you can only do 30 daily transactions.

- You can only move $3,000 per week.

Verdict: The fees for Venmo are smaller than those of banks and money transfer companies. Even if you send a lot of money, you only have to pay a small fee. No fees will be assessed if you want to pay for these services straight from your bank account or debit card.

Price: There are no fees when you pay with a debit card or bank account. Venmo charges a flat fee of 3 percent for payments made with credit cards. Transferring money from a Venmo account to a debit card costs 1 percent or at least 1 percent per transaction.

Website: Venmo

#7) Skrill

The best way to send money and pay online anywhere in the world.

Skrill is a fast online service for sending money that many people trust. The app has been around since 2001, and it lets you pay for famous websites online and send money anywhere in the world.

Features:

- Moving money

- Payments made online

- Helps 38 different currencies

- The most you can move in a day is $10,000. $60 is the least you can send.

Verdict: The best thing about Skrill is that its services are offered to people in almost every country. On the other hand, their prices are higher than those of their rivals. If you can’t use other cash transfer services in your country, you could use Skrill.

Price: It’s free to pay online at some stores. The fee for putting money in is 1%, and the fee for taking money out is $6.5 for banks and 7.5% for credit cards. The fee for a domestic exchange is up to 2%, and the fee for sending money abroad is 1.45%.

There are fees of 3.99 percent for changing money. If you stop using the service, you’ll have to pay a monthly fee of about $6. Other fees include a $29.53 chargeback fee and a $11.81 fee for trying to transfer cash. The fee for giving wrong information, not cooperating, or doing a transaction that isn’t allowed is $177, and the fee for going back on a wrong transaction is $29.53.

Website: Skrill

#8) WePay

Best for people and small business owners who want to use crowdfunding or move money online.

WePay is a company that helps people pay for things. It was started in 2008. This online payment service, owned by J.P. Morgan Chase, could be better for use as a merchant account because it has a low weekly cap. It works better for things like bank payments and crowdsourcing. People from the US, the UK, and Canada can use the online service.

Features:

- Credit, debit, and CH handling on a fundamental level

- Apple Pay can be used

- Reporting at the transaction level

- Each week, you can only spend $10,000 per day.

Verdict: WePay could be better for online merchants or people who want to send significant money. It works well for donations and sending small amounts of money.

Price: Automated Clearing House (ACH) payments cost 1 percent plus 30 cents. For each transaction, customers are charged 2.9% plus $0.30.

Website: WePay

#9) Stripe

The best way to handle payments and billing for online transactions for E-commerce and online companies.

Stripe is an American company that has been making financial tools since 2010. Most of what the company does is help e-commerce businesses handle payments. Its services are offered in 41 countries, and people worldwide can pay for them.

Features:

- Processor of credit cards

- Tools to improve checkout

- Reporting on finances in real-time

- Control when banks get paid.

- Using machine learning to stop theft

Verdict: Stripe is one of the best business options using something other than PayPal. The only problem is that the transaction fees are higher than rival products.

Price: Each credit card charge costs a business 2.9% plus 30 cents. Businesses that handle more significant payments can also get packages made just for them.

Website: Stripe

#10) Square

Small payments from customers are most accessible for small business owners to handle.

Small businesses can get a lot out of Square. Only the US, Canada, the UK, Australia, and Japan can use their cash processing services. It has been around since 2009 and is one of the cheapest payment methods. There are no fees for clearance, business cards, or refunds.

Features:

- It works with magnetic stripes, chip cards, and mobile payments.

- The most you can spend in a day is $50,000.

Verdict: Square is a good option for online businesses, but the number of transactions that can be made daily is limited. Also, the fees for transactions that don’t use credit cards are higher than those of competing goods.

Price: Every credit card purchase costs a business 2.6% plus 10 cents. The fee for entering a payment by hand is 3.5 percent plus 15 cents. It costs 2.9 percent plus 30 cents to pay with Square Online Checkout, Square Online Store, or the eCommerce API.

Website: Square

Conclusion

This blog post has talked about some options for PayPal. These alternatives are suitable for different kinds of businesses. If you are a small business owner worker or work for yourself, Google Pay, Dwolla, Payoneer, and 2checkout are the best alternatives to Paypal.

TransferWise, Stripe, and Square are all excellent options for businesses that do a lot of transfers. For online payment handling, government agencies, companies that sell subscriptions, and non-profits should look into Dwolla and 2checkout.